Medicare Advantage Plans (Part C)

Blue Cross offers a variety of Medicare Advantage plans, which are known for their comprehensive coverage options. These plans, also known as Part C, combine the benefits of Original Medicare (Part A and Part B) with additional services and coverage options. When selecting a Medicare Advantage plan, it’s crucial to consider your personal health needs and financial situation. Knowing your medical history and the types of services you frequently use can guide you in choosing the right plan.

Evaluating the total costs associated with each plan, including premiums, deductibles, and out-of-pocket expenses, is also essential to ensure you’re making a financially sound decision. Some common extras included in Blue Cross Medicare Advantage plans are vision and dental coverage, as well as routine hearing services, which enhance overall healthcare access.

Extra Benefits of Medicare Advantage

One of the standout features of Blue Cross Medicare Advantage plans is the array of extra benefits they offer. These plans often include preventive services without a copay, depending on the specific plan. This means you can access essential healthcare services without worrying about additional costs, promoting better health and early detection of potential issues.

Additionally, Blue Cross Medicare Advantage plans may include vision and dental coverage, routine hearing services, and other enhancements that are not typically covered by Original Medicare. These extra benefits can significantly improve your overall healthcare experience, ensuring you have access to comprehensive care tailored to your needs.

Eligibility and Enrollment Process

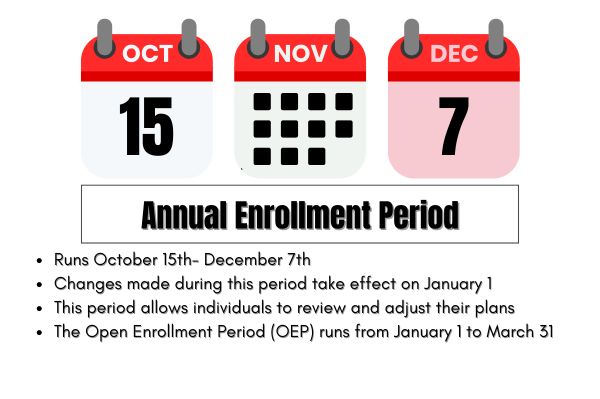

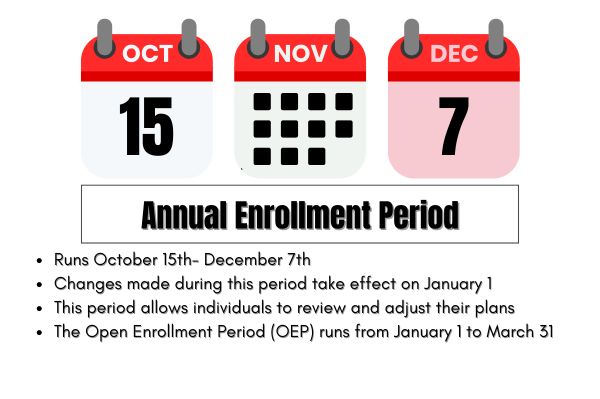

To enroll in a Blue Cross Medicare Advantage plan, you must reside in the plan’s service area. Enrollment happens during specific periods, such as the Initial Enrollment Period when you first become eligible for Medicare, and the Annual Enrollment Period from October 15 to December 7 each year.

Local Blue Cross representatives can provide personalized assistance to help you navigate the enrollment process and select the best plan for your needs. Additionally, community resources such as workshops and informational sessions can offer valuable insights into your Medicare choices and benefits.

Each state also has a State Health Insurance Assistance Program (SHIP) that provides free counseling for Medicare beneficiaries.

Medicare Supplement Plans (Medigap)

Medicare Supplement Plans, commonly known as Medigap, are designed to help cover costs that are not included in Original Medicare. These plans are sold by private insurers like Blue Cross and Blue Shield and aim to fill the gaps in coverage left by Parts A and B. Medigap policies can assist with expenses such as coinsurance, copayments, and deductibles, ensuring that you have more predictable healthcare costs.

Certain Medigap plans may also offer additional coverage for services beyond what Original Medicare provides, such as emergency medical care during international travel. This makes Medigap an attractive option for those who travel frequently or require more comprehensive coverage.

Coverage Details

Medigap plans are specifically designed to cover out-of-pocket costs not included in Original Medicare. These costs can include deductibles, copayments, and coinsurance, which can add up quickly, especially if you have frequent medical needs. Covering these expenses, Medigap policies offer peace of mind and financial predictability for Medicare beneficiaries.

Additionally, some Medigap plans may cover emergency medical services during foreign travel, offering an extra layer of protection and convenience for travelers. This makes Medigap a versatile option that can adapt to a variety of healthcare needs and lifestyles.

How to Apply for Medigap

Eligibility for Medigap requires enrollment in Original Medicare (Parts A and B). Here are the steps to obtain a Medigap plan through Blue Cross:

- Review the Medigap plans available through Blue Cross to determine which plan best fits your healthcare needs.

- Select a plan.

- Complete the application process online or by mail through the specified channels provided by Blue Cross.

After submitting your application, it’s essential to stay informed about your coverage and any changes that may occur. Keeping an open line of communication with Blue Cross representatives can help ensure that your Medigap plan will continue to meet your needs as they evolve.

Prescription Drug Plans (Part D)

Prescription Drug Plans, or Part D, are an essential component of Medicare coverage, providing additional prescription drug coverage to complement Original Medicare or Medicare Advantage plans. Blue Cross offers a variety of Medicare Part D plans, each tailored to cover additional prescription drugs medications.

These plans often come with a monthly premium and may include deductibles or copayments for prescriptions. It’s important to review the specific details of each plan to understand the costs and coverage involved, ensuring you select a plan that meets your prescription drug needs.