Enroll During the Annual Enrollment Period

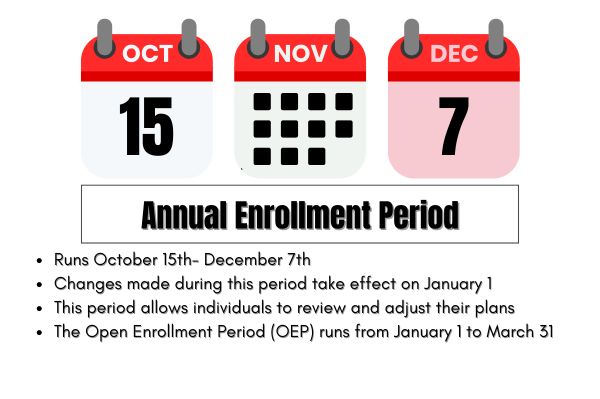

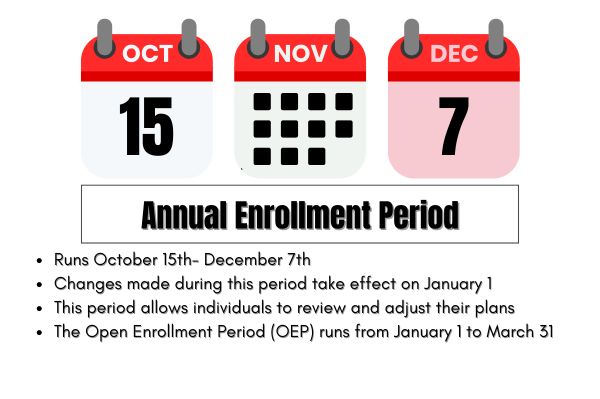

The Annual Enrollment Period (AEP) is a crucial time for anyone looking to switch to a Medicare Advantage plan. Key points about this period include:

- It runs from October 15 to December 7 each year.

- During this time, you can make changes to your Medicare coverage.

- You can switch from Original Medicare to a Medicare Advantage plan.

- You can switch between different Medicare Advantage plans.

- This window allows you to evaluate your current plan.

- You can compare your current plan with other options.

- It helps you make an informed choice for the upcoming year during the advantage open enrollment period.

Mark these dates on your calendar to take advantage of this enrollment period for a new plan. Any changes you make during the AEP will take effect on January 1 of the following year, ensuring you start the year with the coverage that best suits your needs.

Special Enrollment Periods: When They Apply

Special Enrollment Periods (SEPs) offer flexibility for those who experience significant life changes outside the standard enrollment times. Events that can trigger a SEP include:

- Moving to a new area

- Losing job-based coverage

- Getting married These periods allow you to adjust your Medicare Advantage plan accordingly and ensure that you can maintain continuous coverage even when life throws unexpected changes your way.

Eligibility for a SEP requires meeting specific criteria tied to your life event. For instance, if you relocate to a new geographic area where different plans are available, you can use a SEP to switch to a plan that fits your new situation. This flexibility helps ensure that your Medicare coverage remains aligned with your current circumstances.

How to Choose the Right Medicare Advantage Plan

Choosing the right Medicare Advantage plan involves careful consideration of several factors. First, compare the coverage options, costs, and provider networks of a different Medicare Advantage plan. Many most Medicare Advantage plans offer additional benefits such as gym memberships, acupuncture, and transportation to medical appointments, which can be a significant advantage over Original Medicare.

Understanding the costs associated with each plan is crucial. While some plans may have lower premiums, they might have higher out-of-pocket expenses for services. Evaluating these costs in the context of your healthcare needs can help you find a plan that fits your budget. Additionally, ensure that your preferred healthcare providers and facilities are included in the plan’s network to maintain continuity of care.

Additionally, review any extra benefits that specific plans provide. For example, some plans provide coverage for services like acupuncture and chiropractic care, which can enhance your overall health and wellness. Thoroughly evaluating these factors will help you choose a Medicare Advantage plan that meets your needs and preferences.

What Happens After You Enroll in a Medicare Advantage Plan

Once you enroll in a Medicare Advantage plan, the transition is designed to be seamless:

- Your coverage typically begins on the first day of the following month after your Part A or Part B activation.

- If you enroll during a Special Enrollment Period, the coverage will start on the first day of the month after the plan receives your request.

- The Medicare Advantage plan coordinates with Medicare to ensure your benefits transfer automatically, so you don’t have to take any extra steps.

Contact any other Medicare plans you are enrolled in to notify them of your switch. This step ensures proper disenrollment from your previous plan, avoiding overlapping coverage or unnecessary costs.

Automatic Transfer of Benefits

When you switch to a Medicare Advantage plan, your existing Medicare benefits are automatically transferred to your new plan. This seamless process means your new Medicare Advantage plan handles the benefit transfer, so you don’t need to inform Medicare directly.

This automatic transition ensures uninterrupted coverage, allowing you to start using your new plan’s benefits immediately.

Contacting Other Plans to Disenroll

To avoid overlapping coverage and unnecessary costs when switching Medicare plans:

- Notify any other Medicare plans you are enrolled in about your switch.

- Directly contact the provider of your previous plan.

- Inform them of your decision to disenroll to ensure your previous coverage is properly terminated.

If you are enrolled in a standalone Part D plan for prescription drug coverage, you must:

- Disenroll from your standalone Part D plan as your new Medicare Advantage plan will include integrated drug coverage.

- Contact your previous plans promptly.

- Follow the necessary steps to disenroll.

These actions will help you avoid any issues and ensure a smooth transition to your new coverage.

Understanding Medicare Advantage Plan Benefits

Medicare Advantage plans offer a broad range of benefits that extend beyond what Original Medicare provides, including and part b benefits. These plans include:

- All the benefits of Medicare Part A (hospital insurance)

- All the benefits of Medicare Part B (medical insurance)

- Additional services like prescription drug coverage

- Dental coverage

- Vision coverage

- Fitness programs

Verify that your preferred healthcare providers are included in the plan’s network to maintain continuity of care.

One of the significant advantages of Medicare Advantage plans is the annual out-of-pocket limit, which offers financial protection against high medical costs. This cap ensures that once you reach a certain amount in out-of-pocket expenses, the Medigap plan covers 100% of your healthcare costs for the rest of the year, providing peace of mind and budget predictability.

Additional Health Services Covered

Medicare Advantage plans often cover additional health services that are not included in Original Medicare. These services can include:

- Dental care

- Vision exams

- Hearing aids

- Gym memberships

Such benefits are designed to enhance overall health and wellness, making these health care plans a popular choice among most people who value preventive services and wellness programs, including ma plan.

These additional services can significantly improve your quality of life by providing access to care that promotes health and prevents illnesses. By choosing a Medicare Advantage plan that includes these extra benefits, you can ensure comprehensive coverage that meets all your healthcare needs.

Prescription Drug Coverage

Prescription drug coverage is a major component of Medicare Advantage plans. Unlike standalone Part D plans, Medicare Advantage plans bundle medicare drug coverage with other medical services, simplifying the process of managing your healthcare needs. This integration ensures that you have seamless access to prescriptions without the need for a separate prescription drug plan.

Having prescription drug coverage included in your traditional medicare Advantage plan can offer more streamlined and coordinated care. It also means fewer premiums to manage, as everything is covered under one plan. This bundled approach can make it easier to keep track of your healthcare expenses and ensure you have the medications you need.